Bajaj Auto Q3 Results 2025 Live Updates:

Bajaj Auto, the 2 and three-wheeler maker, will announce its Q3 results these days. The automobile essential is anticipated to see a moderate income increase inside the 0.33 zone of FY25. Bajaj Auto’s internet income in the quarter ended December 2024 is envisioned to upward push in a mid single digit. Volume increase and higher realisation are anticipated to guide Bajaj Auto’s Q3 sales growth YoY. However, analysts assume EBITDA margin to agreement marginally YoY due to higher reductions and marketing spends. The organization’s demand outlook in home and foreign places markets could be a key monitorable.

Bajaj Auto Q3 Results Live: Sagar Shetty, Research Analyst at StoxBox shares Bajaj Auto’s earnings preview

Bajaj Auto Q3 Results Live: Bajaj Auto is expected to document decent Q3 profits, with a modest single-digit revenue growth charge projected among five-8%. The subtle 2% yr-on-yr extent growth because of stepped forward average selling prices (ASP) and premiumization strategies is predicted to power top-line increase. Enhanced export contributions are also expected to impact revenue positively. We agree with that EBITDA could be the focal point this quarter. Although lower input expenses and beneficial change costs offer some blessings, the superb effects are probable to be offset with the aid of seasonal reductions and higher contributions from electric vehicle sales.

As a result, we anticipate margins to remain flat or likely decline. Overall, we do now not assume Bajaj Auto to post sturdy numbers this sector. The predicted seasonal rebound for the duration of the festive season did now not materialize due to destocking measures taken in October, main to decrease home volumes.

Bajaj Auto Q3 Results Live: How the automaker fared in Q2

Bajaj Auto noticed a 9.2% growth in net earnings on a standalone foundation, reaching ₹2,half.04 crore, up from ₹1,836.14 crore in the identical area ultimate year. The corporation’s general sales from operations for the second zone grew through 22%, achieving ₹13,127.Forty seven crore, as compared to ₹10,777.27 crore within the previous yr. For the primary time, Bajaj Auto’s sales crossed the ₹thirteen,000 crore mark, pushed by record-high sales in both vehicles and spare elements.

Bajaj Auto Q3 Results Live: Here’s what brokerage Deven Choksey expects from Bajaj Auto in Q3

- For Q3FY25E, we assume BJAUT revenue to grow by using 9.7% YoY/0.8% QoQ, specially because of an growth in quantity of 2.Zero% YoY and 0.2% QoQ along side higher charge realizations.

- The volume increase was driven by an increase in export sales, which grew by way of 22.4% YoY.

- We expect average attention to growth via 6.Five% YoY at the lower back of a higher mix of premium motorcycles.

- We anticipate EBITDA margins to boom by way of one hundred twenty five bps YoY ( 107 bps QoQ), driven with the aid of operating leverage advantages and commodity tailwinds.

- Net profit is probable to develop with the aid of 16.5% YoY (48.Three% QoQ)

Bajaj Auto Q3 Results Live: MOSL’s expectations from Bajaj Auto’s Q3 results

- PAT seen at ₹2166 crore, up 6.1% at the same time as sales may want to rise 7.5% YoY to ₹13,027.8 crore.

- 2W volumes grew ~1% YoY as home 2W volumes declined 10% YoY. On the opposite hand, 3W volumes grew 6% YoY. Exports grew ~22% YoY, indicating sustained recovery in the worldwide markets.

- We anticipate the effect of a weaker blend (within home and exports lower 3W domestic mix) to effect EBITDA margin by way of 40bp sequentially to 19.Eight%.

- We reduce FY26E EPS via 13% to element in weaker domestic call for, KTM woes, and decrease margins.

Bajaj Auto Q3 Results Live: Nuvama Reserach sees 4% YoY growth in PAT, revenue and EBITDA

Nuvama Research’s estimates:

Revenue at ₹12631 crore, up four% YoY

PAT at ₹2123 crore, up 4% YoY

EBITDA at ₹2520 crore, up four% YoY

“Volume boom and better recognition shall support revenue growth YoY. EBITDA margin shall agreement marginally YoY due to better discounts/advertising spends. Key element to look at out for is demand outlook in domestic and remote places markets,” said Nuvama on expectations from Bajaj Auto’s Q3 income.

Bajaj Auto Q3 Results Live: Bajaj Auto share price trades marginally higher on BSE ahead of results

Bajaj Auto Q3 Results Live: Bajaj Auto percentage rate traded marginally higher on BSE ahead of outcomes nowadays. At eleven.05 am, Bajaj Auto stock was at ₹8415.25, up zero.42%.

Bajaj Auto Q3 Results Live: Elara Capital expects automaker’s PAT to grow by 3% YoY

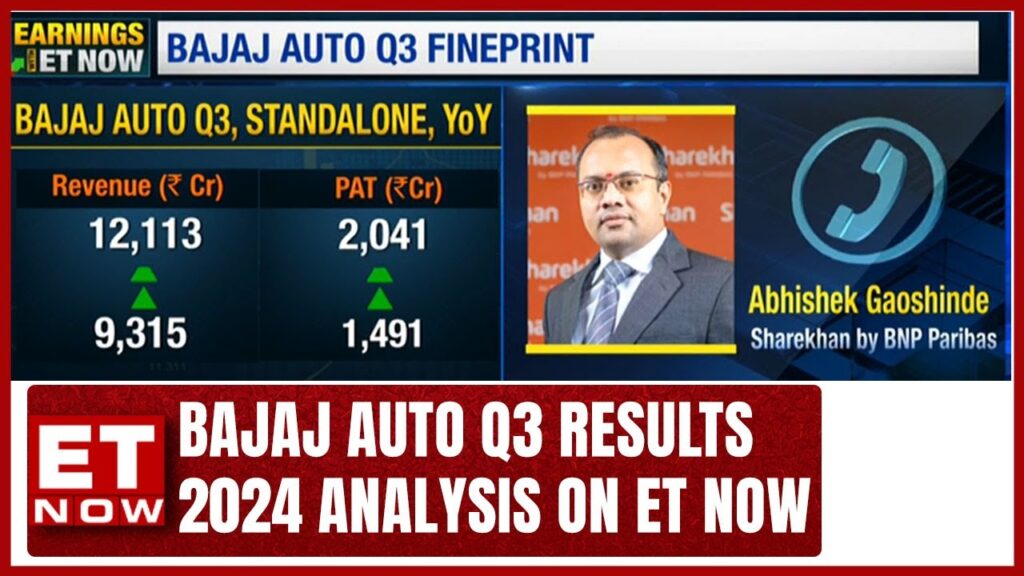

Bajaj Auto Q3 Results Live: Bajaj Auto’s Q3 profit is seen at ₹2041.9 crore, up 2.Eight% YoY and four.7% QoQ, according to Elara’s estimates. Revenue could grow 6.9% YoY however decline 1.3% QoQ to ₹12113.5 crore, as per the brokerage. EBITDA is seen at ₹2430 crore with a margin at 20.1%, down seventy one bps YoY and eighty five bps QoQ.

Bajaj Auto Q3 Results Live: Bajaj Auto to announce Q3 results today

Bajaj Auto Q3 Results Live: Bajaj Auto, the 2 and 3-wheeler maker, will announce its Q3 consequences today. The car main is predicted to peer a slight earnings increase in the third sector of FY25.