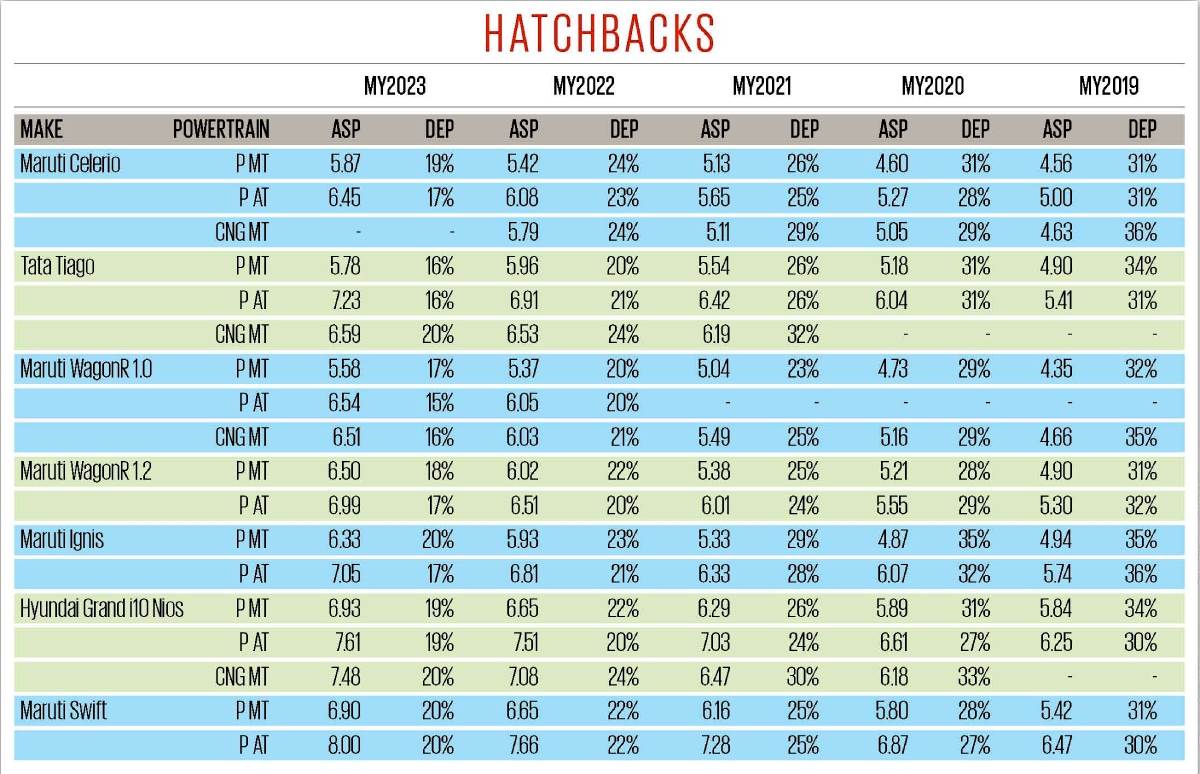

The hatchback market in India is notably led by Maruti Suzuki, holding four out of six positions with models such as Ignis, Celerio, Wagon R, and Swift. The remaining two contenders in this segment are the Hyundai Grand i10 Nios and the Tata Tiago.

Used Hatchbacks Resale Value Study Results

One- and Two-Year-Old Examples Retain Value Better Than Competitors

The four Maruti models in this category showcase stable and predictable depreciation rates, ensuring they maintain strong resale values. Notably, the Maruti Ignis tends to depreciate faster after its third year due to its unique market position and limited customer base.

One of the most exceptional performers is the Maruti Swift, achieving a remarkable resale value of up to 73 percent after five years, making it a standout in retaining its market value among hatchbacks.

Despite Maruti’s dominance, the Hyundai Grand i10 Nios Petrol AMT has emerged as an unexpected top performer, showing the least average depreciation over five years among its peers. This trend reflects a significant movement in the hatchback market, where automatic variants now fetch a notable premium compared to manual options, paralleling their increasing popularity in new car sales.

Additionally, the Tata Tiago, especially the petrol-manual version, demonstrates strong short-term value retention. One- and two-year-old Tiagos are retaining their value better than many other models, indicating robust buyer confidence in the vehicle.

Autocar India-Spinny Resale Value Study

This analysis stems from a collaborative study by Autocar India and Spinny, a prominent used car platform functioning in 22 cities across India, including major metros like Delhi, Mumbai, Bangalore, and Chennai. Spinny provided average selling prices based on actual sales data from 21,944 vehicles sold throughout its network in the 2024 calendar year. When evaluating the data, if a model was available in multiple engine types or variants, these were averaged for comprehensive results. Depreciation rates were calculated based on the percentage loss between the vehicle’s original on-road price at the year of manufacture and its resale value in 2024.

Also see:

Hyundai Verna resale value best among midsize sedans.

Used Tata Punch prices driven by new car demand.

Used Toyota Glanza prices similar or lower than Maruti Baleno.

Maruti Dzire retains 70 percent of its price after 5 years.